3. Write all your expenditures down in one place daily

Dec 04, 2019Here’s an exercise to find out how savvy you are about where your money goes. I use it with my clients. If you think you have a good idea of where your money goes, it may surprise you.

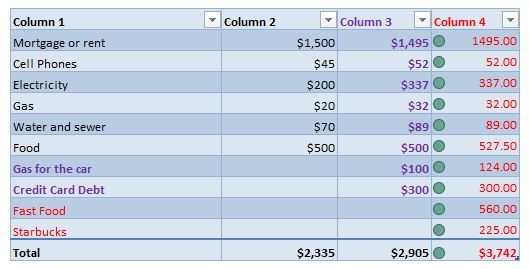

Make four columns on a sheet of blank paper. You’ll need three different color inks for writing in each column, saving red for the last column. In the first column, using black ink, write down (without looking) all your monthly expenses by name; things like your mortgage and cell phone bill. In the second column, the same color, write down how much you spend on them.

Now, in the third column using purple ink, go to your computer and/or checkbook and find the entries you have for these things. You may find a few other items that you forgot to write down the first time and that’s okay. It’s what we want to see. Let’s say you forgot Gas (transportation) and your credit card payments. Add them now and write down what you really spent on everything so far. Great.

The last column takes some time. For an entire month, keep every single receipt for everything you spend every day – every single receipt for every single thing you do. Each night, add them to the last column using red. Don’t try to change your spending habits yet, just keep the receipts. This will really open your eyes to what you spend and where. You’ll be surprised. Also, make adding these receipts to your list a habit that you do for 10 minutes each night. If you don’t, the task can become overwhelming, even in a week. Isn’t 10 minutes a day worth being debt-free and creating financial security for your family. You bet it is! So, do it. Input those receipts every night.

After you’ve done this exercise, you will value the importance of writing everything you spend down and writing it all down in one place. Lots of my clients only used their checkbooks to gauge what they were spending each month but were forgetting things like automatic payments and items they paid cash for. Your brain likes to see it all in one place to get the big picture. It really helps. So, make it a habit. Put it all down in writing and in one spot for your brain.

Previous

Next - Step #4

Want to hire a Virtual Assistant but don't have a clue about how to get started...

We've created a program just for you inside our membership, VA Advantage. Not a member yet? We've got you covered, too. We've made this program available for "outsiders" for a limited time and for less than $20. Grab it now before it's too late!

Go and Grow...

If you want to become financially free, you need the right education. That’s why we created our Mini-Courses on investing in Short-Term Rentals. If you are serious about investing your time and money into an Airbnb (aka Short Term Rental), you need a system. Our courses are jammed packed with everything you need to know to create massive, passive income. Plus, they're affordable.

and take a look at July's BNB Budget Makeover Series inside our blogs...

This month, we give you loads of great ideas on using your orphan days to make inexpensive changes to your properties. Begin here, with Budget Room Makeovers: Weekend Projects for Under $1000.

Don't miss a beat!

New articles, blogs, podcast episodes, and courses delivered to your inbox.

We hate SPAM. We will never sell your information, for any reason.