How to Balance Your Checking Account, Even When You Don't Have a Checkbook

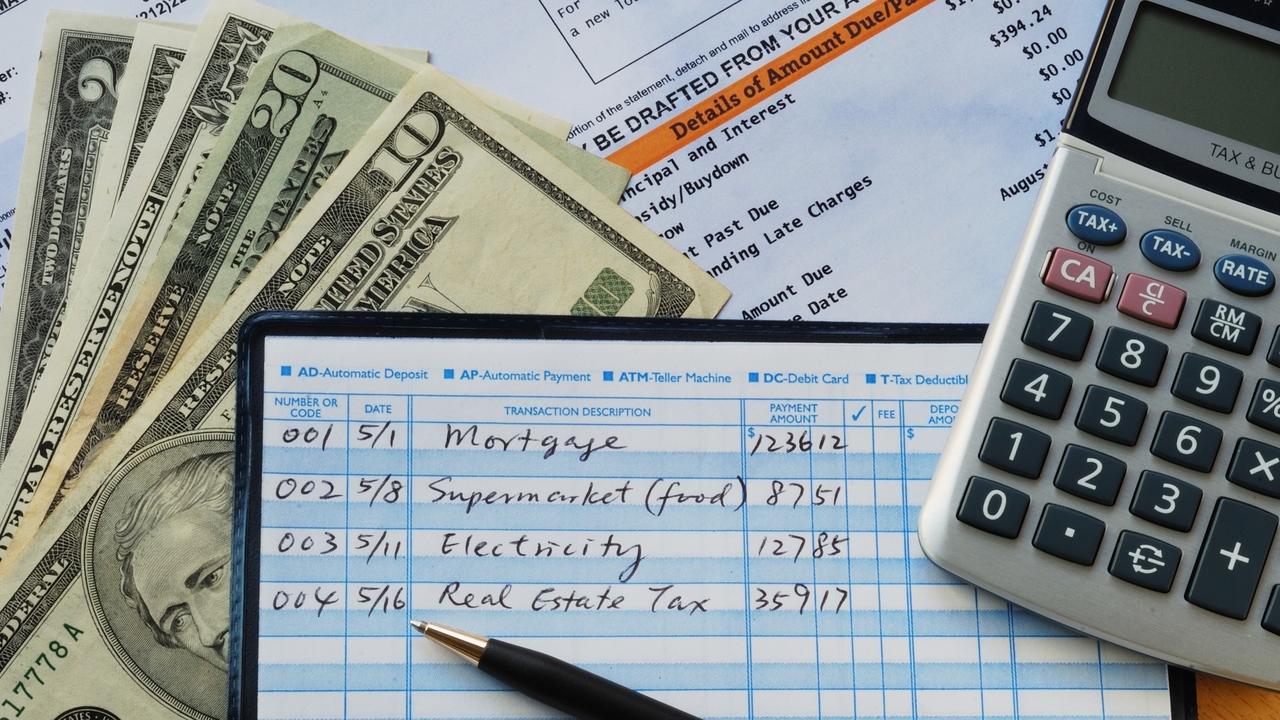

Sep 21, 2018Because very few people still use personal checks and check registers (the little white book where you would write down each check and deduct it from your account balance), there are some young’uns who don’t know the meaning of balancing a checkbook, nor do they have any clue about how to do it. It's almost a lost art. We hope this helps them…and you, if you are among those who don’t know how.

Balancing your checkbook simply means that you record all the deposits and all the withdrawals you have made to your checking account and “balance” them with the deposits and withdrawals recorded by your banking institution. The transactions should match, hence the word balance. These additions and subtractions to your account are called transactions. The reason you record all your transactions to any account is to know exactly how much money you have available in that account at any given time. It also lets you know if there have been any transactions to your account that you may not be aware of, so balancing your account is good to do at least once a month, if not more.

How do you balance your accounts?

Don’t worry. It’s pretty easy. The only thing it really takes is diligence, doing it thoroughly and as often as possible. You will need to write down every deposit you make into your accounts taking note of where the money came from (like your paycheck), the amount, and the date of deposit. Do the same for each withdrawal. For every withdrawal, write down where you spend your money (like Amazon or Chipotle), what you spent it on (a book or a burrito), how much was withdrawn, and the date. If you don’t write down where you are spending your money, at least keep a receipt for each transaction to record later.

The Steps to Balancing Your Checkbook

Step One - Gather all your receipts, deposit slips, and written transactions: every deposit and withdrawal you have made since the last time you balanced your account.

Step Two - Open your balance sheet and your bank statement online or on paper. I balance my accounts to an excel spreadsheet where I keep my monthly budget. You can balance yours on a piece of paper if you want. The transactions don't have to be in order of date but that does make it easier to balance. I use my paper bank statement because I like to draw a line through the amounts as I match the transactions.

Step Three - The beginning balance of this month's statement should match the ending balance of last month's. Now just go through each transaction one by one, checking them against your balance sheet or budget as you go.

Step Four - Look for any transactions that you did not make, especially withdrawals. If something was taken out of your account without your permission, you'll need to contact the bank. The same if there were strange deposits made.

Step Five - Subtract any checks, debits, or withdrawals of any kind not already recorded in your account to the bank's ending balance. Add any deposits not recorded in your account to that balance.

Step Six – Adding the deposits and subtracting the withdrawals from your ending balance will leave you the current balance you have to work within your account.

Every month, when you get your account statement, do the same accounting for each and every transaction. Your checkbook and your bank statement should look exactly alike as you should be accounting for each transaction and marking them off.

Most bank account or credit union statements come with a handy worksheet attached to make it easier. Some banks even have forms online. You can even use a piece of scratch paper. All you are really doing is making certain that you and your bank have recorded the exact same transactions in the form of deposits and withdrawals. That’s all. Nothing more.

What goes hand in hand with your checking account is your budget. Everyone should create a budget. Learn how here. Also, learn where most budgets leak money here. Creating a budget and balancing your accounts are the two main activities that will propel you forward in controlling your money and your own economy. Good luck.

Michelle R Russell

© The Prosperity Process, LLC

for BNB-Boss

Want to hire a Virtual Assistant but don't have a clue about how to get started...

We've created a program just for you inside our membership, VA Advantage. Not a member yet? We've got you covered, too. We've made this program available for "outsiders" for a limited time and for less than $20. Grab it now before it's too late!

Go and Grow...

If you want to become financially free, you need the right education. That’s why we created our Mini-Courses on investing in Short-Term Rentals. If you are serious about investing your time and money into an Airbnb (aka Short Term Rental), you need a system. Our courses are jammed packed with everything you need to know to create massive, passive income. Plus, they're affordable.

and take a look at July's BNB Budget Makeover Series inside our blogs...

This month, we give you loads of great ideas on using your orphan days to make inexpensive changes to your properties. Begin here, with Budget Room Makeovers: Weekend Projects for Under $1000.

Don't miss a beat!

New articles, blogs, podcast episodes, and courses delivered to your inbox.

We hate SPAM. We will never sell your information, for any reason.